Featured Stories

All About AB5: Inquiring Minds Want to Know

“Registered California Voter?”

“Yeah.”

The signature gatherer held up a clipboard with a sheet and looked at me earnestly. “This would allow Uber and Lyft drivers to continue as independent contractors,” he said.

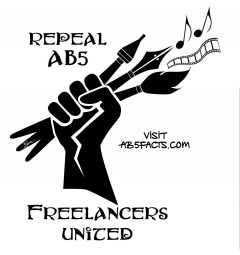

This was mid-February as I stood outside a Ralph’s supermarket, less than two months into 2020 and the implementation of the gig economy law; there was already an organized drive to place a proposition on the ballot to repeal it. There are also about a half dozen new bills introduced to the legislature aimed at limiting the law.

The full name of the law is 36 words long; so everybody just refers to it by the legislative bill number AB5. As has been explained by lawmakers in Sacramento, the law was intended to codify and clarify a California Supreme Court workers’ rights decision from 2017 or what is called the Dynamex decision.

Since the first of the year, when AB5 went into effect, for musicians there have been worries, rumors, misinformation, lost gigs, cancelled performances, band leaders who are now employers, and bass players and drummers who are now employees entitled to workman’s comp. The Troubadour delved into AB5 and how it is affecting local musicians. Before we do, let’s take a look at some background that led to AB5.

AB5 Codifies a California Supreme Court Decision, But Why Was There a Decision in the First Place?

Musicians have always worked gigs. But the gig economy for the rest of the U.S. labor force dates back to the early nineties. Starting back then job applicants were told that they had gotten the jobs they had applied for, only to find out that there were no jobs, that they had been hired on as independent contractors. They would work, receive a check, but they wouldn’t have vacation pay, sick pay, overtime pay, or worker’s compensation; they would pay all of their Social Security and Medicare taxes themselves. They would also be denied protections against employment discrimination and sexual harassment.

This happened in the wake of a devastating recession. Folks needed work, so they reluctantly signed on with corporations as contractors. It was also the age of NAFTA, when, for American corporations, cutting costs went from a prudent practice to a religion. Corporations before this time would have listed customers, employees, stockholders, and even the communities in which they did business as being their responsibility. This thinking changed with Milton Friedman. The economist, who received the Nobel Memorial Prize in economic sciences in1976, had argued in a 1970 New York Times essay that companies have no social responsibilities. None. Zero. Zip. Nada. Corporations, Friedman argued, are only responsible to their stockholders. A lot of folks, particularly folks who own a lot of stocks, took this as economic Gospel.

Transforming employees to contractors lowered most companies’ costs by about 30 percent and—because individuals cannot take advantage of economies of scale, buying group insurance plans and paying wholesale for their supplies—worker expenses increased by 35 percent, possibly more.

Uber was founded in 2009, Lyft in 2012, and Doordash came into being in 2013. All of these app companies classify their drivers as independent contractors. Before their arrival, gig economy workers might incllude a graphic designer who works at home. The artist would have the investment of a PC, software, and other office supplies. Uber and Lyft drivers use their own cars, which is a larger capital investment. They also pay for their own car insurance and gasoline.

The California Supreme Court Decisions

Since 1989, in California, the question of who can be classified as an independent contractor had been governed by the California Supreme Court’s decision of S.G. Borello & Sons, Inc. v. Dept. of Industrial Relations. The Borello decision established 13 criteria needed for a business to classify someone as an independent contractor, such things as whether the work performed require special skills, the length of time of the work, and whether the work performed is part of the usual business of the employer.

In 2004 Dynamex, a nationwide courier service, converted its entire labor force from employees to contractors. Two workers subsequently sued, and the case went to the California Supreme Court. In April of 2018 the Court ruled in favor of the workers, and in so doing established a more comprehensive standard than Borello, what is referred to as the ABC Test. Under the Dynamex decision, in order to classify a worker as a contractor a business needs to establish that: (A) the worker is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact, (B) the worker performs work that is outside the usual course of the hiring entity’s business, (C) the worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed.

The Court Decision Becomes Law

AB5 took much of the language of the Dynamex decision, retaining the ABC test, and added some clarifications and exemptions, such as those for physicians and lawyers. Nonetheless portions of the law are vague. For example, AB5 lists fine artists as being exempted without defining what a fine artist is. Would a musician fit this description?

In mid-February, over 100 Lyft and Uber drivers filed wage claims with California’s Labor Commission Office. They want to be classified as employees, and want to be reimbursed for back wages and overtime pay, as well as expenses such as insurance and gasoline—amounts that could reach as much as $100,000 for some drivers. Organizers of Rideshare Drivers United, an association of rideshare drivers, expressed frustration that AB5 was not being enforced.

The complaints of rideshare drivers go beyond overtime pay and workman’s comp. Lyft and Uber do not have to ensure that their drivers have bathrooms or bathroom breaks. As a result, these drivers have nowhere to relieve themselves. Restaurants, which provide restrooms to their customers, are denying Doordash drivers the ability to use their restrooms when they pick up food. Think of that next time the delivery driver hands you your El Pollo Loco.

Uber and Lyft say they will not comply with the law and are hoping for a repeal. They are also making small changes to their apps, in hopes that the tweaks can keep the classification of their drivers as independent contractors.

Large performance organizations, such as orchestras that already employ musicians as employees, have not voiced concerns over AB5. It is the midsized opera, dance, and performance companies that rely on short-term contract work from musicians and other artists that have been burdened. The Island City Opera, a small but ambitious company in Alameda County, has postponed an opera production scheduled for this month because of AB5. The small-venue Pocket Opera in San Francisco has also voiced concerns.

There has also been backlash from freelance writers, who must write fewer than 36 articles for a publication to retain their independent status. Vocal opponents include gigging musicians.

Southern California Musicians Speak Out

The Troubadour reached out to musicians to see what effect, if any, AB5 has had on them. We received about a dozen responses. Several said that they had seen no effect from AB5 at all. They were still playing gigs or hiring musicians as independent contractors.

Chris Klich is a jazz saxophonist (as well as other reed instruments) and educator. An in-demand performer and bandleader, he has not experienced a change, with a busy schedule through the end of 2020. He nonetheless is concerned about the effect the law may have and that it is only a matter of time before the law affects him. Klich believes that at some point there might be an establishment that would say it couldn’t employ him. He is hopeful that the law can be made more amenable for artistic freelancers. “I was encouraged to read that Lorena Gonzalez is open to making carve outs for musicians and photographers,” he says. “I think we need to keep the pressure on to make sure that she does indeed follow through with that.”

Some musicians said that they were confused by the law. “It was scary and everyone seemed to be freaking out that it was the end of the music business as we know it!” says singer/songwriter Astra Kelly. For Kelly, a full-time self-employed musician for the past seven years, the effects have been a matter of providing paperwork to the places where she gigs. “So far, I have been asked by four venues to provide a copy of my business registration and insurance in order to continue working with them. One of those four said if I didn’t have this, they would need to add me as a temporary employee. I have a DBA and liability insurance in place, so I was able to provide this and remain an independent contractor with them in all cases.”

Musician and writer Lindsay White considers a freelancer’s life to be one of constant competition with other freelancers, and AB5 may present yet another obstacle in a freelancer’s life. “[T]his also scares me from a business owner perspective,” she says, and adds that she lacks the capital to offer employee status to the different artists who perform at her showcases. “I think the original intent of this law was to protect workers, which I respect, but the potential harm seems to outweigh the perceived benefit.” She believes that AB5 is the kind of well-intentioned law that pushes people to do business under the table. “I believe in laws that protect workers, but we shouldn’t hurt them, or the small businesses that rely on them, in the process.”

Ryan Bueter is the owner and manager of the Killer Dueling Pianos, which has been entertaining weddings, fundraisers, holiday parties, and other events since 2010. He has converted seven performers from contractors to employees. “All the shows that we’re doing in 2020 were booked six to 18 months in advance. The shows were agreed upon and the prices were set,” Bueter says. “Now I have added expenses like workman’s comp, a payroll company, employer payroll taxes, and new accountant fees. With these additional expenses, I’ve had to tell the performers working with me that they aren’t going to get what I told them they were getting.” Bueter adds that the musicians complain that as employees they lose the ability to write off their instruments and other expenses.

Besides reducing the pay for his musicians, the changes he has made also affects Bueter’s bottom line. “With some jobs I’ve put people on, I’m actually losing money. I’m underwater for the gig,” he says.

Bueter sees much of AB5 as bringing about absurdities. He says, “If I hire some one for three hours, they are my employee now.” To fix AB5 Bueter wants a full exemption from the law if you file as a musician, except in the case where someone is a full-time musician for an establishment such as the Los Angeles Philharmonic.

Michael Tiernan is a full-time musician who also DJs for weddings. On the advice of his accountant, he changed his business from being a contractor to being an employer. He has dropped some gigs, because they are now too cost prohibitive and has let go a number of musicians.

Tiernan’s biggest fear is the EDD, which can inflict huge fines for noncompliance. “You pass 11 of the law’s requirements but don’t pass just one, and you can be considered noncompliant,” he says. “With my other music projects, I’m at a loss for what to do because I can’t afford to bring everyone I work with on as employees.” Though he has changed his business model, Tiernan concedes that most of his colleagues in the wedding industry—photographers, florists, wedding planners, who all work as independent contractors—have told him that most are not changing their business model.

Tiernan now finds himself in some sort of employer/contractor netherworld. “I’m now an employer, but I don’t have the rights of an employer. I still have to call up guys and ask them if they can do a gig.”

Although he believes that some people need employment protections, Tiernan describes AB5 as a huge step backwards and favors a complete repeal. “The language of AB5 is too vague. It at least needs to be amended and cleared up. There needs to be an exemption for nonunion musicians. I don’t know how AB5 is going to affect my original music career, things like hiring guys for studio time or hiring a producer for a recording. It can make you feel like packing up and leaving California.”

Update

I politely declined to sign the petition, explaining that I was a freelance writer working on an article about the very law that the proposition promised to revoke and that I needed to retain my impartiality.

2/18/20: As of my deadline, the latest news is that there was a protest in City of Industry against AB5, with a crowd numbering in the dozens. Speakers at the protest said they had lost work from employers who were hiring workers from out of state or opting not to hire extra workers.

2/18/20: A U.S. District Judge rejected a motion from Uber and Postmates, a food delivery company, to stop the enforcement of AB5.

2/18/20: Assembly member Kevin Kiley is initiating a floor vote that will temporarily suspend AB5 while legislation to amend it is considered.

2/18/20: The office of Lorena Gonzales, author of AB5, had initially returned my email, but I heard nothing further from her office.

2/18/20: The office of Kevin Kiley, who is sponsoring legislation to repeal AB5, never returned my email.

2/27/20 Barbara Bry, whose criticism of AB5 was initially measured, has come out in opposition to the legislation and is calling for repeal. Bry is running for mayor of San Diego. Her opponent, Todd Gloria, coauthored AB5.

2/27/20 AB1928, a bill introduced by Kevin Kiley that would have suspended AB5 while further changes to the law are proposed and voted on, was voted down by the California legislature.